PLATONIC IDEALS: R2-D2 AND HOW TO BUILD SCALABLE ROBOTICS BUSINESSES

February 18, 2025

Software may have eaten some of the world (and we know AI-powered software innovation is coming for more of it), but it’s left behind a host of complex, tangible challenges that can’t be solved through code alone, like unclogging a pipe or building a bridge. This is why we’re particularly excited about the robotics revolution unfolding before us. It represents the intersection of technological innovation and real-world impact, where software and hardware must work in harmony.

We’re part of the chorus of techno-optimists shouting, “The robots are coming!” — but perhaps not for the reasons many think. The robot revolution isn’t just about technological capability. It’s about economic necessity. A worsening labor shortage, combined with improving technology and rising living standards, means fewer people want to do many essential but unpleasant jobs that undergird our physical reality. This creates a perfect opportunity for robotics innovation.

While much has been written about production line automation in manufacturing-dependent industries like cars and consumer goods, we want to focus on robots that move and operate in the real world. More specifically, we want to explore what makes these robotics businesses not just technically feasible, but economically viable and profitable at scale.

While companies like Figure are making impressive strides in humanoid robotics, we believe that purpose-built, non-humanoid robots will be an integral part of our future — not C-3PO, but rather R2-D2. There’s a host of discrete, repetitive tasks humans can but typically don’t want to do, from delivering pharmacy drugs inside hospitals to picking up trash in parking lots, from cleaning airport toilets to inspecting remote solar farms, from changing car tires to assembling prepared meals. Just because a human can do a job doesn’t mean the human form factor is optimal for that task.

But first: Is it a robot? Or just a fancy tool?

Before diving deeper, let’s establish a clear definition: If it replaces an entire job, it’s a robot. If it merely supplements or augments a person who is still required to do the job, it’s a tool. This distinction is crucial for understanding both the technology requirements and business potential of different robotics approaches.

If it needs hand-holding to learn how to replace a person but will ultimately replace a person, then it’s a robot. But that’s not a business yet — that’s either a very expensive, venture-subsidized research project, or it’s a tech-enabled service provider … with much of its overhead budget going towards a very expensive, venture-subsidized research project. (More on the importance of autonomy later.)

With this axiomatic definition in mind, anyone building or investing in this space will want to prioritize use cases and pricing models where you do not have to take on any utilization risk. But, assuming you do have to take on utilization risk, strive towards utilization north of 80%, ideally 100%. Tasks and opportunities that are most conducive to meet these criteria tend to be high-frequency tasks typically outsourced to a third party. Founders who can identify and capture these opportunities are effectively collapsing a value chain by helping their customers vertically integrate. They are also tapping into existing budget line items and can generate a clear ROI, all while benefiting from a smoother sales motion.

R2-D2: The Platonic Ideal

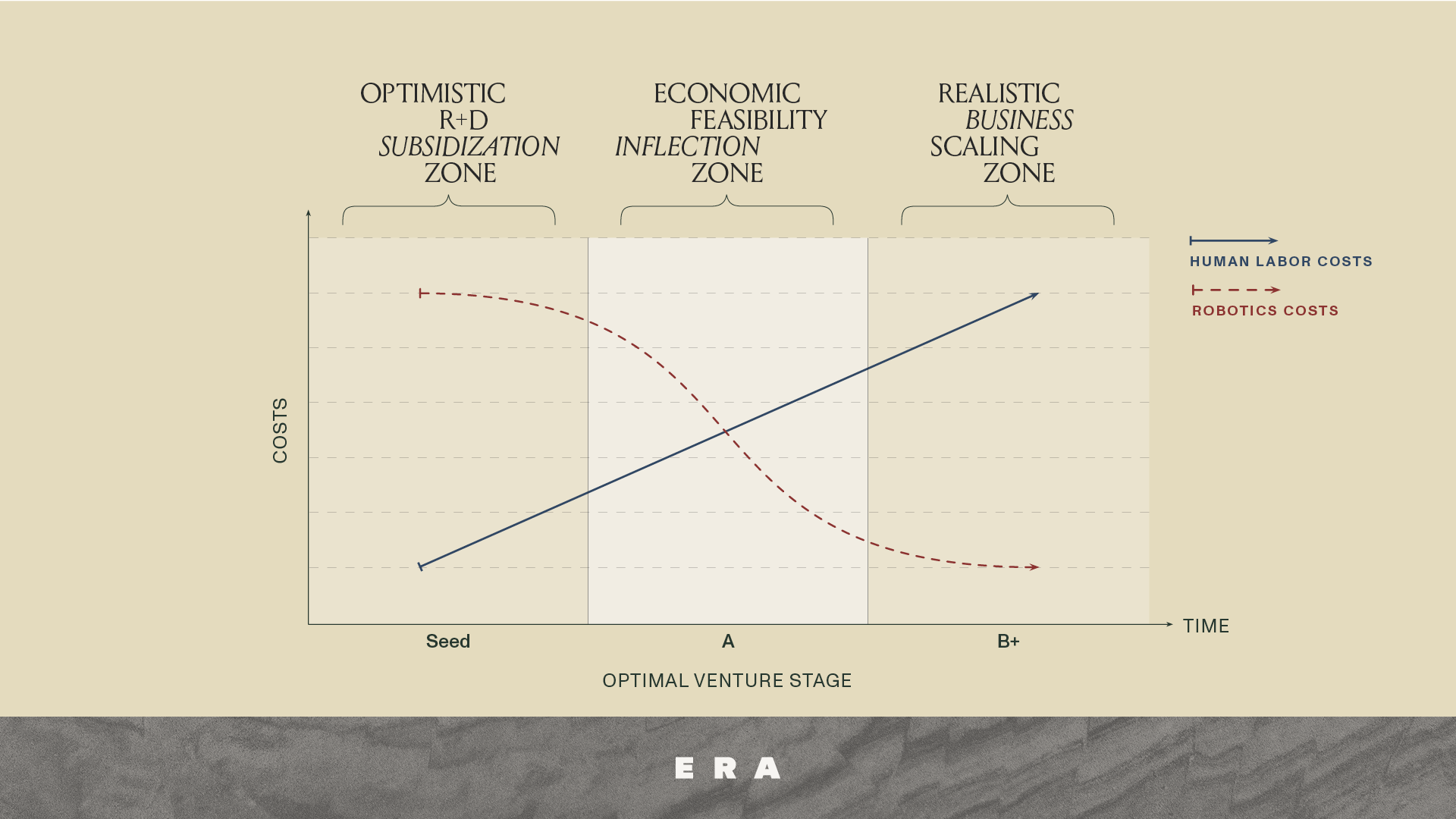

Many single-purpose robots are quickly reaching a point where they are cost-competitive with human labor and operate at compelling gross margins. We can chart the human vs. robot cost curve for any given job and get a chart like this:

Human labor costs continue to rise over time, while robot labor costs continue to fall, driven by cheaper hardware and stronger AI/ML models. The economic argument to switch from human to robot becomes compelling once human-equivalent robot labor is near cost parity with human labor. This is where product-market-fit magic happens, and in a labor-constrained world, robots should effectively sell themselves. While some regulatory and behavioral inertia issues remain, you must clear the economic hurdle to be in a position to outcompete and totally replace manual labor.

What are the tactical milestones and metrics a founder should build toward as they chase this platonic ideal of a robot so good and so profitable they can slot it in place of a human? We think of them in three categories: technology, operations, and unit economics. If you are able to check enough of these boxes, the world is yours to dominate (the world being the one not-so-platonically-ideal job no one but your robot wants to do — but hey, there’s a lot of money in those jobs!).

Technology: Human bodies are regenerative multi-purpose machines. They’re capable of performing at extremely high levels and for multiple decades, and yet we often apply them to low-level jobs, which makes those jobs ripe for automation. But that doesn’t mean that doing so requires recreating the human body. There are three key technical criteria we’ve identified to measure how good a robot is at being “human-equivalent,” none of which has anything to do with what it looks like:

Reliability:

- The robot should perform its task as well as or better than a human.

- Key metric: Uptime in the field. For robots that move around, many start around 80% reliability; the ideal is 95%+.

- Reality check: Uptime will never hit 100% consistently. Hardware in the real world — especially in exposed or outdoor environments — will always face issues (bad weather, human interference, etc.) that startups cannot and should not overengineer for.

- Reality check again: Humans don’t have 100% uptime, either, be it due to tardiness or a sick husband at home. That said, R2-D2s can and should beat humans at this metric — production line robots have this all figured out already.

Durability:

- The robot should perform its job with minimal maintenance for as long as possible.

- Key metric: Time to total failure. Many MVPs and early robot iterations don’t last more than 2 to 3 years before it’s cheaper to stop fixing them and just build a new one. Ideally, they should last for 4 to 6 years with minimal or predictable maintenance. Most robots will need to operate for that amount of time for their unit economics to add up to something compelling, but do run your own math. Your mileage may vary.

- Reality check: You never know when a truck will decide to drive into your bot or when a forklift accident will happen inside your warehouse. What you can control, however, is consistent quality output under idealized conditions. Then build enough of a margin of safety across your hardware to endure through as many edge cases as your users might reasonably encounter during the scaling phase.

Quality:

- The robot should do its job well enough. Many humans aren’t that great at their jobs, but robots need to have consistent and improving quality output.

- Key metric: This will vary by use case. Define this metric thoughtfully, benchmark to human output, match it, then beat it.

- Reality check: Performance improves the more robots you have in the field and the more data you collect. This is why your robot may benefit from some early hand-holding as it learns to do its job well. The sooner you get it to perform high-quality work durably and consistently, however, the sooner you move from running an R&D project to building a truly scalable business.

Autonomy:

- The robot should be able to operate independently or with minimal human guidance or intervention.

- Key metric: Operator-to-robot ratio. Many start at 1:1. The ideal ratio is 1:20 or 1:30, but depending on your unit economics, you may get diminishing returns in terms of gross margin after 1:10, especially if you outsource operators overseas. Figure out what makes sense for you, but set a high bar.

- Reality check: You will always want a human in the loop, but you want to maximize the number of robots per human. Otherwise, you veer dangerously close to “fancy tool” and away from “robot.” (Human operator costs also have direct implications on gross margin, which we’ll discuss later.) Finally, you may be able to get your customer to be that human in the loop, by rebooting a stuck robot, for example.

- Reality check again: While the ultimate goal may be (near) full autonomy, and while you can get to 90% or even 95% autonomy in a reasonable period of time with a good team, you’ll always have new edge cases, and you’ll always be learning. This long tail of constant chaos and how well you react to those edge cases can be the difference between an acceptably imperfect robot and a subpar one.

Operations: Okay great, you have a machine that can replace a human. Demand is through the roof, and these bots are flying off the selves (quite literally in some cases.) Now what? You need to get as many of them as possible into the real world.

Production:

- You need production capacity at the right cost and quality to meet the expected demand for your awesome new machine.

- Key metric: Units per month. Many companies start with the ability to produce a handful of units at a time and do it in house. Scale often requires a third-party product partner.

- Reality check: There are cost and quality tradeoffs to different approaches, and some might be tempted to build their own factories. Your R2-D2 should be simple (and cheap) enough that others can build it at scale for you. You do not want to take on manufacturing risk at scale if you don’t have to — not before you hit $100 million in ARR — but we welcome pushback on this point.

Deployment:

- You should be able to ship the robot from the factory to the customer site. All prep work required should be done by the customer or a third party.

- Key metric: Order-to-deployment time, broken down by material lead time, production time, inventory holding time, shipping, and any on-site work required to install the robot. You do not want to hold inventory (parts or bots) because you want to optimize your cash cycle.

- Reality check: There’s much you can’t control early on. Producing to order is hard, and you want to be in a financial position to have a production and deployment buffer. Further, your customer may need to do some of the prep work on site, and that can cause deployment delays.

Maintenance:

- Your robots will always need to be maintained, and you should be able to service them efficiently through a combination of in-house and third-party providers.

- Key metric: Mean time to failure, and subsequently annual maintenance cost per bot. You want to optimize both.

- Reality check: You always want to do maintenance yourself early in your product’s life before outsourcing to a third party. Early robot models will fail more often than subsequent generations. The better you build, the more durable they are. Maintenance ties directly to operating costs and depreciation, as well.

Unit economics: So we have a robot that works and the operational infrastructure to get it in customers’ hands at scale. How do we make money?

Business model:

- Are you a Robot-as-a-Service (RaaS) business with monthly or annual payments? Or are you a capex business that sells the robot once?

- Key metrics: NRR and account size. These serve as proxies for: “Have you really figured out how to sell to the right people?” Ideally you have customers who can support dozens if not hundreds of robots, but this varies by use case.

- Reality check: You want to go slow before you go fast. Again, optimizing everything listed above is a multi-year journey that you will need to take alongside your early customers.

Payment (and repayment) schedule:

- This often derives from your business and pricing model. You want to optimize this before you start to scale, otherwise scaling will burn too much of your venture dollars.

- Key metric: BOM repayment. Ideally you never have to front cash because you’re paid enough upfront and your manufacturers are okay with net-60 to net-90 payment terms.

- Key metric 2.0: If you want to play on hard mode, run your business such that you’re paid upfront in excess of BOM (shipped and landed), plus year-one operating costs (humans plus software required to run the bot for a year), plus maintenance and repair costs. Now that’s how you make money. Harder mode? Get customers to pay a deposit upon signing a contract with you, ahead of manufacturing.

- Reality check: You will need debt (or venture equity) to subsidize the capital intensity of the first several (dozen) robots, especially if your initial price or payment terms are not enough to cover your hardware costs. This is a big part of why these businesses are expensive and difficult to scale.

- Reality check again: Good businesses take time to optimize. Markets take time to mature. It’s not realistic to expect that your robot will be fully cashflow-positive in year one. That said, the earlier you chart a path toward that, the easier it will be for you to scale your business quickly.

Gross Margin:

- Per-bot margin flows from all of the above and is often most sensitive to asset-depreciation period and the number of humans per robot.

- Key metric: Gross margin as a percent of revenue, ideally exceeding 50%. Can you hit 60%, though? Can you beat software’s 70%?

- Reality check: Many companies will operate at a low, if not negative, gross margin as they explore autonomy and pricing power. That is okay, as long as you have the capital to subsidize your R&D efforts and the line of sight to positive unit economics with enough development and scale. Remember, your margin will improve first based on technology, not economies of scale.

Our ideal scenario — a robot that performs a specific task on its own for years while generating healthy cash flows — may seem straightforward, but the journey there is winding. The most successful founders we’ve seen approach this challenge methodically, focusing on the fundamental metrics we’ve outlined above rather than chasing “classic” metrics like ARR alone. They are ultimately able to produce and deploy as many robots as the market demands of them and do so without a cash crunch — maybe even at a cash surplus!

Founders will spend years building towards that ideal. Some will find a steeper-than-expected technological curve. Others will face production and operational hurdles. Still others may find themselves serving customers in markets where market conditions, namely customer willingness to pay relative to the cost of human labor, have not yet crossed into the zone of economic feasibility illustrated above.

The potential practical impact, however, is enormous. Every successful robotics deployment represents a real-world problem solved, a labor shortage addressed, or an efficiency gained. As we’ve emphasized throughout this piece, building in the physical world requires a different mindset than building for the internet. It demands patience, precision, and a deep understanding of both technological and economic constraints.

At Era Ventures, we’re committed to partnering with founders who share this vision of thoughtful, sustainable robotics innovation. We believe the next wave of robotics companies won’t just be technologically impressive — they’ll be built on sound business fundamentals and clear paths to profitability.

Are you a founder building a robotics company? Have questions for us? Please feel free to reach out directly to Raja: raja@eraventures.com

Here’s to the R2-D2 revolution!

🤖🦾