THE BUILT WORLD

NEEDS REBUILDING

The facts paint a stark picture – The world’s largest industry is its most inefficient.

From the park bench to the industrial complex, the ways that we live, work, play, and grow are directly defined by our physical world. Yet, the past century of human technological advancements has barely touched the built environment, which remains largely stagnant.

Globally, real estate has lagged behind most other economic sectors in its embrace of technological innovation and, subsequently, in its productivity gains. Today, it is the second least digitized industry in the world, behind only agriculture. Productivity in construction has barely increased in decades, rising just 1% annually compared to 3.6% for manufacturing. Beyond the macroeconomic view, the environmental toll of the built world is enormous: buildings consume 40% of global energy and contribute 30% of greenhouse gas emissions. The status quo is unsustainable.

In the US, the picture is even grimmer: The average age of a commercial building in the U.S. is 53 years old. Much of our built environment is deteriorating and obsolete. Housing has become increasingly unaffordable.The average home price has soared from twice to almost six times the median annual income since 1960. Adding insult to injury, the US has not built enough homes to keep pace with the last 40 years of population growth.

The result: the veritable fossilization of the world’s largest asset class. And yet, the real estate and construction industries remain the single largest contributors to global GDP, and while opaque, they’re highly profitable. In 2023, the US alone spent over $2 trillion on construction, with an estimated 40% profit pool. That’s double 2019’ $1 trillion – a whopping $1 trillion of growth in highly profitable economic activity over a 5-year period. Similar examples abound across asset classes and lifecycles. The industry’s profit pools are so large that even a small, single-digit market share in any submarket can generate a multi-billion-dollar company.

In an era of sustained technological progress, the disconnect between the built environments we have and the ones we need has never been greater. Incremental change is not enough. Much of the real estate industry doesn’t just need an upgrade – it needs a complete reimagining.

But why has this massive part of the economy resisted change for so long?

THE PHYSICAL WORLD

IS RIPE FOR DISRUPTION

The physical World has been primed for disruption for decades, yet, it managed to resist most forms of technological advancement. The open secret about humanity’s oldest industry is that it’s structurally disincentivized to innovate:

- It’s fragmented, disproportionally privately owned and local. This limits open-market competition and creates local, stagnant monopolies with no economic pressure to innovate or improve their products and services, breeding complacency and a willingness to settle for the bare minimum.

- It’s highly regulated and risk-minimizing. This creates a perverse incentive structure where overperformance is rarely rewarded properly, while underperformance is often severely punished.

- It’s a transactional, cyclical industry with poor user experience: From homebuyers to corporations, customers often face subpar interactions with industry providers. The industry’s cyclical nature, marked by frequent business failures and restructurings, compounds this issue. With most transactions being one-off, there’s little incentive for providers to prioritize customer experience, perpetuating the problem

These dynamics go far in explaining the stagnation of the world’s largest asset class. Building businesses to take advantage of these opportunities is not easy. The growth frameworks and investing approach that have fueled the internet revolution don’t always apply seamlessly to physical world disruption. The physical world is not the internet: atoms are not bits, and buildings are not websites. The real estate industry is complex, regulated, and intensely cyclical. Transforming it requires a nuanced understanding of its unique challenges and a tailored approach to navigate them.

THE INEVITABILITY

OF CHANGE

All physical world industries boil down to three core elements: people, materials, and capital. Today, powerful trends are converging to upend each of these:

- Technological development, be it cheaper hardware, more powerful AI, or more efficient energy sources, will continue to supplement and eventually replace repetitive and laborious tasks, yield better environmental results, and guide new capital deployment. Technology will simultaneously improve the fundamental unit economics of old business models and help create new ones.

- New marketplaces will help individuals and businesses find and trust other people, businesses, suppliers, and sources of capital and materials. The more supply or demand these marketplaces can unlock and bring to bear, the more advanced, impactful, and valuable they will be. Many new platforms will be created in response to an actively shifting macroeconomic and global trade landscape.

- Capital continues to demand more from physical world assets. More and more asset classes will institutionalize, and interdisciplinary capital will fuel the growth of new kinds of startups in the space. A new generation of asset managers will thus guide the deployment and stewardship of a growing number of novel and scaled real asset classes.

- The realities of human experience and the importance of our natural world are becoming central to the success in the physical world. This is reflected in ‘consumerization’ of real estate, with a shift of thinking of occupants as nameless, faceless tenants to more embodied customers, and in the increasing significance of brand and experiences in generating value for physical world assets. It’s also driving a need for newer, better materials and for more efficient and sustainable systems.

Era exists to back founders who see around the corner and plan to leverage these inevitable forces to build the next generation of systems to power the physical world. We believe that a radical reinvention of the built environment is inevitable. The question is not if the change will come but who will drive it and how it will unfold.

THE INNOVATION

CONTINUUM

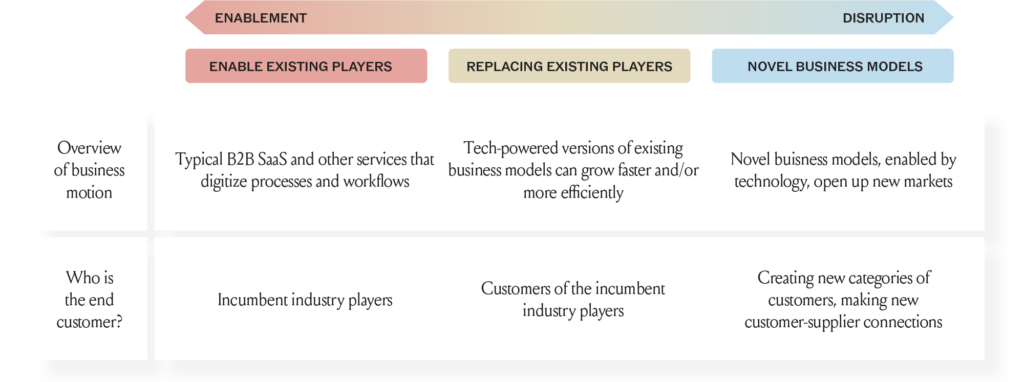

To realize our vision of a radically rebuilt real estate ecosystem, we need an analytical framework to understand and contextualize that innovation. We beleive that innovation in the physical world lies on a continuum. From least to most innovative, we have:

Enablement: Incrementally improving existing processes and business models, often through software (e.g. Procore, ServiceTitan, VTS). Enablement plays in the last bull market cycle have often focused on digitization – helping incumbents move off paper. A necessary foundation, but rarely transformative on its own.

Replacement: Rebuilding traditional offerings from the ground up, delivering superior products and services, or providing traditional ones but with far superior economics (e.g. Nest). A major step forward, but still bounded by conventional paradigms.

Transformation: Fundamentally rewiring market dynamics by connecting previously siloed supply and demand, disintermediating gatekeepers, and capitalizing on structural inefficiencies. Airbnb, bringing new supply to the hospitality market, is a prime example of a truly disruptive play. This is the promised land of innovation, where outsized impact and returns reside.

At Era, we invest across this spectrum, but our true north star is transformation.

We appreciate that many businesses in the physical world are worth enabling, even if many are already well-served by the software platforms of the last 10+ years. We also see the potential in replacing many, but not all, of the existing value chains, collapsing them where appropriate. Ultimately, we exist to back visionary founders with the courage and capability to tackle the built world’s most entrenched challenges and revolutionize its largest profit pools. This is where we believe the biggest opportunities and the most meaningful transformations lie.

THE PROPTECH ECOSYSTEM

IS VAST AND VARIED

The term “Proptech” has become a catch-all for the diverse array of innovations reshaping the built world, and often serves as a proxy for incremental technologies meant to serve the status quo.

At Era, we have a much broader definition of physical world innovation. We have identified seven core business models which we think are essential to the full transformation of our physical environments:

| Business Model | Description |

|---|---|

| AI and SaaS | Platforms that arm real estate operators and investors with the insights and digital tools to drive better decisions and streamline operations. |

| Marketplaces | Platforms that connect fragmented supply and demand across physical world submarkets, unlocking new efficiencies and opportunities. |

| Fintech | Novel financial products and services, from mortgages to insurance to payments, tailored for the unique dynamics of real estate. |

| Tech-enabled Services | Companies that upend traditional service providers by integrating cutting-edge tech into their core offerings. |

| Hardtech | Pioneers developing and deploying frontier hardware and software, from sensors to robotics to AI, to revolutionize how physical spaces are designed, constructed and maintained. |

| Balance Sheet Businesses | Innovators leveraging their own capital to amass physical assets and generate superior risk-adjusted returns. |

| Propco/Opco | Ventures that leverage new technologies and business models to acquire, operate and optimize physical assets in innovative ways. |

These business models come with different revenue qualities, levels of capital intensity, and subsequently valuation multiples. No singular business model can capture the full profit pool available in our industry and are all thus very valid experiments on the path to rebuilding the business infrastructure of the physical world.

Notably, all of these models share a common DNA: the application of technology, creativity and entrepreneurial vision to staid physical world problems. Each represents a potent vector through which to catalyze change. Collectively, they form the foundation of a burgeoning ecosystem that is actively transforming the built environment in the years and decades to come.

A NEW ERA FOR

THE PHYSICAL WORLD

We are not incrementalists.

At Era Ventures, accelerating physical world transformation is our driving purpose. We believe that a wave of innovation is poised to disrupt real estate at every level – and we founded Era to back the bold founders reimagining the future of the physical world. Guided by our firsthand knowledge of the industry’s pain points and potential, and inspired by a bold vision for the future, we are building a platform to identify, fund, and scale the ideas redefining how physical spaces are built, transacted, managed and experienced.

We believe immense financial alpha exists in this mission. We are proud to primarily align our interests with those of financially motivated, institutional LPs, and to support the impact of leading universities, hospitals, and foundations.

We bring this fund to the world with both rigor and care. We seek to engage with humility, kindness, and diligent curiosity, recognizing that the best ideas often come from unexpected places.

So let’s begin. Together with the visionary founders and companies who inspire and motivate us, we are excited to architect a new era for the built world – brick by byte, building by building, space by space. An era of intelligent, adaptive environments. An era of buildings that don’t just house us, but empower us to live, create, and connect to our fullest potential. An era where real estate is not a static structure, but a dynamic platform for progress. An era where we no longer work for the physical world, but one where the built environment works for us.

The opportunity ahead is immense and urgent. The multi-trillion dollar real estate industry, the bedrock of our economy and our lives, is on the precipice of generational transformation. Through partnership, collaboration and inspiration, we believe this transformation will yield a more prosperous, sustainable and equitable future for all.

It’s time to rebuild the future. We hope you’ll join us.

Onward,

The Era Ventures Team